Singapore Strategy

BUMITAMA AGRI LTD

P8Z.SI

CHINA AVIATION OIL(S) CORP LTD

G92.SI

CITY DEVELOPMENTS LIMITED

C09.SI

Singapore Strategy

BUMITAMA AGRI LTD

P8Z.SI

CHINA AVIATION OIL(S) CORP LTD

G92.SI

CITY DEVELOPMENTS LIMITED

C09.SI

STRATEGY - What If Brexit?

- We analyse the implications of Brexit on the FSSTI and highlight stocks that could be impacted by the long-awaited upcoming referendum on 23 June.

WHAT’S NEW

All eyes on the referendum.

- The referendum on 23 June to decide whether Britain should leave or remain in the European Union will be a closely watched event.

- This research reports analyses the impact of a potential Brexit (Britain Exit) on the FSSTI stocks.

ACTION

Rising odds on leaving but too close to call.

- Our check, based on Bloomberg’s poll, indicates rising odds of a Brexit.

- From a high of 54% (on 16 Feb 16) to remain in the EU, the latest poll indicates that this percentage has declined to 43%. This compares with the 42% in the “leave” camp, which suggests a very close call as the “undecided” segment of 15% will likely determine the outcome.

- Other non-partisan information on UK attitudes on the referendum indicates a close call, with the latest estimates at 51% to remain and 49% to leave the EU.

Implications of Brexit on the GBP.

- UOB Global Economics and Market Research (UOB GEMR) believes that ultimately, the UK will vote to stay in the EU. However, it would be a very close call and the GBP/USD is likely to remain volatile in the run-up to the referendum on 23 June.

- While there have been calls for a 20% decline in the GBP/USD in the event of a Brexit, UOB GEMR thinks this is too excessive.

- Key levels to watch out for would be 1.3836 (2016 low) followed by 1.3503 (2009 global financial crisis lows).

Potential economic implications.

- While the full extent of the potential economic implications is unknown, Brexit could have significant implications on the economy beyond the foreign exchange. This could include a weaker GDP outlook and implications in areas such as investments, trade and the current account deficit.

- In terms of economic impact, sources such as The Economist predict a three-level impact, with the near-term impact seen in a sell-off in UK assets and a weaker pound.

- The impact on GDP would be 3-4% below baseline non-Brexit forecast by 2017-18 and about 6% below by 2019-20.

- There would also be political implications as a Brexit would make it more challenging for Prime Minister David Cameron to survive the political fallout.

Stock-specific implication.

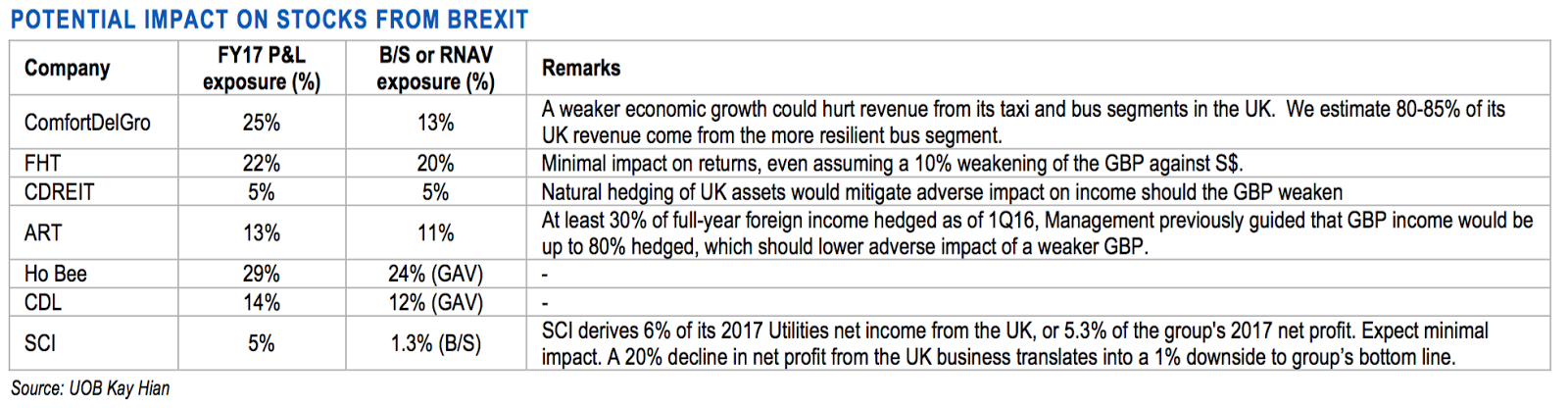

- In terms of stock exposure, companies with significant exposure to the UK include Ho Bee, ComfortDelGro, FHT and City Developments (please refer to table below for respective companies’ P&L and balance sheet exposure to the UK).

- Our discussions with these companies indicate a wait-and-see stance as the outcome of the referendum remains difficult to predict.

- In addition, these are long gestation investments and any major decision will be carefully considered.

- Maintain BUY on ComfortDelGro, Ho Bee, City Developments and FHT.

- For SIA (HOLD/Target S$11.60), Europe accounts for 9% of its group revenue but euro-denominated revenue is likely to be less than 4% of total revenue. Any negative impact could be partially offset by higher traffic to the region. In the near term, yields could fall, but medium-term impact would be negligible as SIA could hedge its exposure.

Sniper approach for FSSTI as opportunity arises on volatility.

- Our blended (PE cum P/B) target of 2,910 for the FSSTI implies a limited 5% upside. Hence, we think investors will need a “sniper” approach to outperform. We see intermittent bouts of market volatility from a potential Brexit, impending rate hikes, recovering oil prices and mixed macro data. This could provide attractive entry levels for patient and disciplined investors.

- While Brexit is not our base-case scenario at the moment, we would remain relatively defensive and position accordingly.

Themes for 2H16 and key stocks for action.

- In our view, any significant pull-back is a potential buying opportunity.

- Key themes include:

- M&A,

- dividend yield with catalyst,

- recovering tourist arrivals, and

- going global.

- Large-cap BUYs include CDL, DBS, Singtel, ST Eng, A-REIT, CDREIT and Bumitama.

- Mid-cap gems include CAO, NeraTel, Valuetronics and Innovalues.

- SELL SIA Engineering, StarHub and M1.

KEY STOCK RECOMMENDATIONS

Andrew Chow CFA

UOB Kay Hian

|

Singapore Research Team

UOB Kay Hian

|

http://research.uobkayhian.com/

2016-06-15

UOB Kay Hian

SGX Stock

Analyst Report

1.30

Same

1.30

1.56

Same

1.56

10.36

Same

10.36